does tennessee have inheritance tax

There are NO Tennessee Inheritance Tax. Tennessee does not have an estate tax.

Where S My Tennessee Tn State Tax Refund Taxact Blog

There is no federal inheritance tax but there is a federal estate tax.

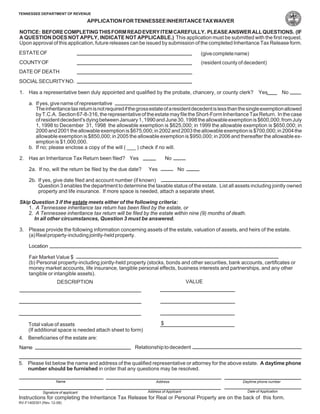

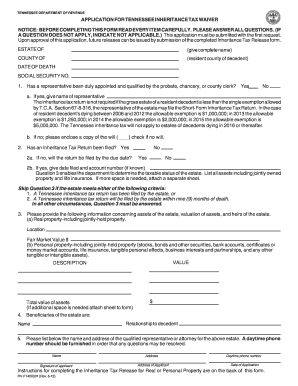

. The executor will determine which form is necessary and go from there. Tennessee does not have an inheritance tax either. Inheritance Tax Due Date and Tax Rates File and Pay Exemptions Consent to Online Transfer Forms Publications and Other Resources Inheritance Tax Forms Note.

Tennessee Texas Utah Virginia West Virginia Wisconsin Wyoming A federal estate tax is in effect as of 2021 but the exemption is significant. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses.

Tax Returns State Inheritance Tax Return Long Form. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. The inheritance tax is no longer imposed after December 31 2015.

In 2021 federal estate tax generally applies to assets over 117 million. For the purposes of this post we are going to address the last question about Tennessees inheritance tax. Tennessee Inheritance and Gift Tax.

The inheritance tax is levied on an estate when a person passes away. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Technically Tennessee residents dont have to pay the inheritance tax.

Those who handle your estate following your death though do have some other tax returns to take care of such as. IT-15 - Inheritance Tax. Inheritance Tax in Tennessee.

Twelve states and Washington DC. Maryland is the only state to impose both. Tennessee Terminology What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate exceeds a certain value.

The federal government does not impose an inheritance tax. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

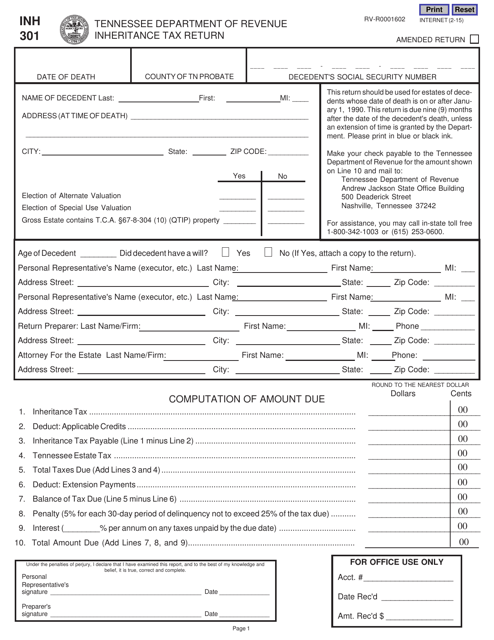

Impose estate taxes and six impose inheritance taxes. The Tennessee Department of Revenue has two forms one for estates that are less than 1 million and one for estates that are greater than 1 million. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Only those estates that are valued 5 million or more are subject to the Tennessee estate tax. Does Tennessee still impose an inheritance tax.

It is one of 38 states with no estate tax. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. Inheritance Tax in Tennessee.

Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. For example the neighboring state of Kentucky does have an inheritance tax.

Final individual federal and state income tax returns each due by tax day of the year following the individuals death. An inheritance tax is essentially a tax on the amount of money or assets the heirs or beneficiaries of an estate receive. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

117 million increasing to 1206 million for deaths that occur in 2022. The inheritance tax applies to money and assets after distribution to a persons heirs. All inheritance are exempt in the State of Tennessee.

For example if you inherit a traditional IRA or a 401k youll have to include all distributions you take out of the account in. States That Have Repealed Their Estate Taxes. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016.

Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax.

What Other Taxes Must be Paid. The inheritance tax is different from the estate tax. Please DO NOT file for decedents with dates of death in 2016.

In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. However it applies only to the estate physically located and transferred within the state between Tennessee residents. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident.

The inheritance tax is paid out of the estate by the executor. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. Tennessee is an inheritance tax and estate tax-free state.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. According to the Tennessee Department of Revenue Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents. If you pass away in Tennessee with an estate less than 1 million there is no inheritance tax.

Divorce Laws In Tennessee 2022 Guide Survive Divorce

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

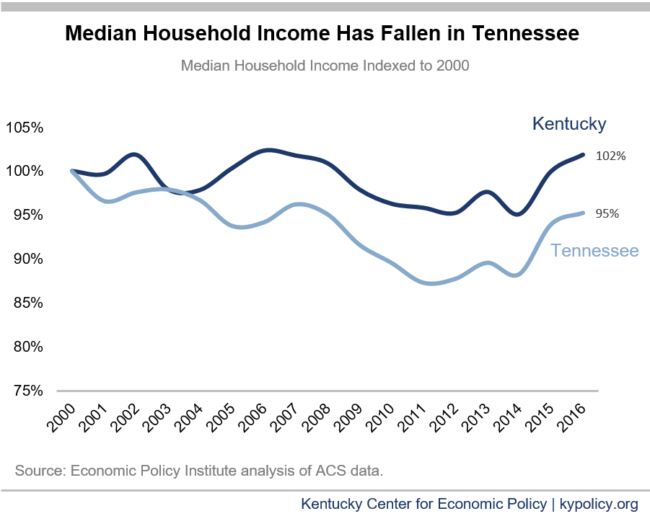

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Form Rv R0001602 Inh301 Download Fillable Pdf Or Fill Online Inheritance Tax Return Tennessee Templateroller

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Retirement Tax Friendliness Smartasset

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Historical Tennessee Tax Policy Information Ballotpedia

A Guide To Tennessee Inheritance And Estate Taxes

The 10 Most Miserable States In America States In America Wyoming America

Probate Fees In Tennessee Updated 2021 Trust Will

The Surviving Spouse Estate Tax Trap When Someone Dies Estate Tax Inheritance Tax

What You Need To Know About Tennessee Will Laws

Tennessee Health Legal And End Of Life Resources Everplans

Tennessee Inheritance Laws What You Should Know Smartasset

Kentucky Or Tennessee To Retire Kentucky Tennessee Retirement

Tennessee Inheritance Laws What You Should Know Smartasset

Tennessee Inheritance Laws What You Should Know Smartasset

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller